8915 e form tax act

When will Form 8915-E be available. It should walk you through the questionnaire.

M O Cpe The Definitive Tax Seminar

The CARES Act states that the additional 10 tax does not apply to any coronavirus-related distribution up to 100000 Act Sect.

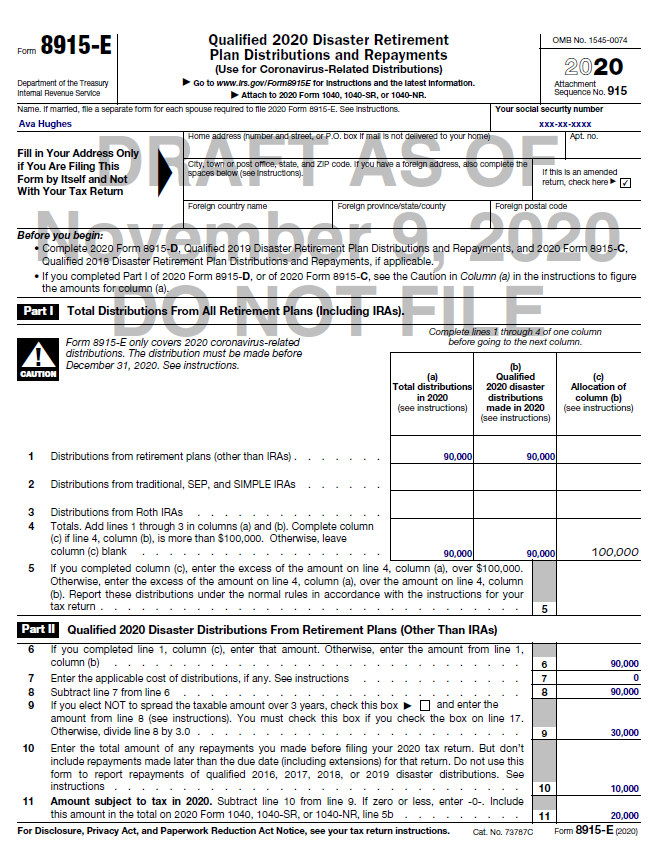

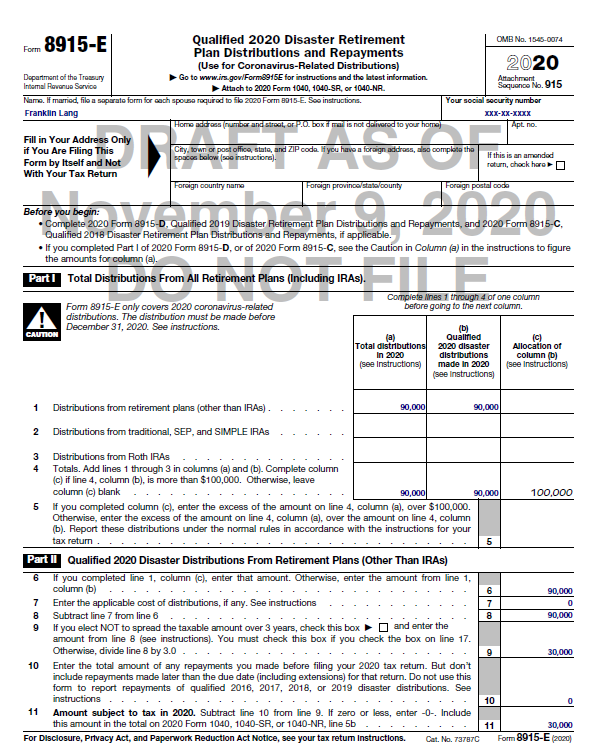

. Only the early withdrawal 10 penalty will be completely waived. To do that the participant must file Form 8915-E. To enter or review Form 8915-E information.

Please be aware that these. From within your TaxAct return Online or Desktop click Federal. If you filed Form 8915-E in 2020 because you took a retirement distribution due to COVID-19 hardship then the IRS will require you to file a 8915-F this year.

Sign at the bottom of page two if you are filing Form 8915-E by itself and not with your tax return. If you are not required to file an income tax return but are required to file Form 8915-E fill in the address information on page 1 of Form 8915-E sign the Form 8915-E and. The form is on TaxAct my return has it.

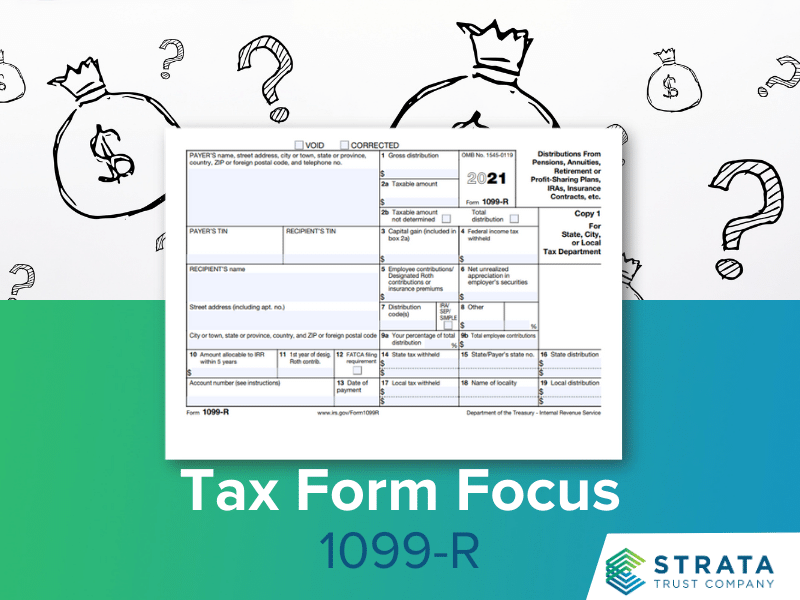

You can use the steps below to make sure you have chosen the right steps to. To enter or review Form 8915-E in the TaxAct program. Form 8915-E will be completed automatically based on how the interview for Form 1099-R is completed.

On smaller devices click in the upper left-hand corner then click. Through the CARES Act of 2020. In order to do so the participant must designate the withdrawal as a coronavirus-related distribution when heshe files taxes.

Make sure you enter the 1099-R and check the box on that screen that it was due to a qualified disaster. From within your TaxAct return Online or Desktop click Federal on smaller devices click in the top left corner of your screen then click. Form 8915-E will allow you to pay tax on one third of the distribution over the next three tax years.

Irs Releases Guidelines For Coronavirus Related Distributions And Loans Taken From Retirement Plans Under The Cares Act

Irs Releases Faqs On Coronavirus Related Retirement Plan Changes Found In The Cares Act

Cares Act Distributions Tax Reporting Guidance Rules Examples Resources And More Youtube

Solved Form 8915 E Is Available Today From Irs When Will The Program Make It Available For Me To File Page 2

Tax Form Focus Irs Form 1099 R Strata Trust Company

Taxes And The Cares Act What Retirement Savers Need To Know On Filing For 2020 Barron S

Forgot To Reverse Withdrawal From Retirement Account Here S How To Fix It

National Association Of Tax Professionals Blog

Publication 4492 A 7 2008 Information For Taxpayers Affected By The May 4 2007 Kansas Storms And Tornadoes Internal Revenue Service

National Association Of Tax Professionals Blog

Irs Warns Of Delays And Challenging 2021 Tax Season 10 Tax Tips For Filing Your 2020 Tax Return

How Your 2020 Taxes Are Affected By The Coronavirus Pandemic The New York Times

Cares Act Retirement Plan Provisions With Updates As Of July 2020 Tri Ad

Irs Issues Guidance On Cares Act Retirement Plan Relief Sgr Law

Reminder Due Dates For 2020 Tax Returns And The Change Of Tax Day To May 17th Wegner Cpas

What You Need To Know About Coronavirus Related Distributions Before Filing Your 2020 Tax Return

Publication 4492 A 7 2008 Information For Taxpayers Affected By The May 4 2007 Kansas Storms And Tornadoes Internal Revenue Service

Irs Issues Faqs Regarding Cares Act Distributions And Loans From Employee Benefit Plans Pullman Comley